The Other Cities: Migration and Gentrification in Jersey City, Newark and Paterson describes housing trends and neighborhood transitions in three mid-sized North Jersey cities that elude conventional descriptions of gentrification. All three have experienced population growth, increased immigration, loss of Black residents and a persistent lack of housing affordability. We describe their particular dynamics three ways: "Bedroom City", "Jobless Gentrification" and "Migrant Metro." Jersey City is the “Bedroom City” where population growth and higher prices are associated with its proximity to jobs across the Hudson River in New York City. Newark is in the midst of “Jobless Gentrification” where investment in expensive market-rate new housing and investor-led renovations raise prices without the corresponding job growth seen in traditional gentrification. Paterson is the “Migrant Metro”, a species of municipalities that have become mosaics of working-class immigration whose density alone—not jobs or new housing—has intensified a lack of affordability. These characteristics distinguish them from traditionally gentrifying cities, but their traits are important bellwethers of urban life across the U.S.

Read MoreNew Jersey's Assembly Bill A4 represents a landmark effort to comply with the Mount Laurel Doctrine and the state's growing affordable housing crisis by reforming how municipalities meet their fair share housing obligations. At the heart of this legislation is a standardized formula that requires each municipality to calculate its present and prospective affordable housing needs, along with other factors like population growth, land, and income capacity. By decentralizing housing planning, A4 shifts responsibility to local governments from the state and gives them a ten-year window to meet their fair share housing obligations.

Read MoreThere are many circumstances that could lead to failure to pay mortgage payments or property taxes. Unfortunately, in far too many cases, default on a mortgage or taxes leads to mortgage or tax foreclosure—where creditors seek to reclaim the property subject to the default.

Read MoreOn January 12, 2024, Governor Phil Murphy signed the Wealth Preservation Program law, an ambitious reorganization of the foreclosure process in favor of second chances, non-profit rights of second refusal and affordable home ownership. Then-Assemblywoman, now-Senator Britnee Timberlake, introduced this law because New Jersey has the highest foreclosure rate in the country, with one foreclosure for every 2,271 homes.[1] The potential impact of this law goes beyond just reducing the number of foreclosures. It potentially limits institutional investors’ opportunities to purchase foreclosed homes at sheriff’s sales by providing ordinary homebuyers initial opportunities to bid on properties on more favorable terms. Under the Act, defaulting homeowners, their next of kin or tenants have the first chance to re-purchase their homes from sheriff sales at a publicly disclosed discount price by paying only a 3.5% down payment with 90 days to close. If they do not elect to purchase, non-profit community development corporations (CDCs) have the next right of refusal in exchange for deed restrictions that keep the property affordable to subsequent owners or renters.

Read MoreOn July 10, 2024, Governor Phil Murphy signed a tax sale revision law (A3772/S-2334), which modifies the process for investors engaged in tax sale foreclosures and provides steps for homeowners to protect their equity. Senator Brian Stack (D-33) introduced this law in January 2024 in part because of the case of a 94-year-old Black woman named Geraldine Tyler, who lost her home and equity in the tax sale foreclosure process. In 1999, Mrs. Tyler purchased a one-bedroom condominium in Minneapolis, Minnesota. She lived in the condominium until 2010 when problems in the neighborhood prompted her to rent an apartment in a safer area. She experienced financial difficulties, leading her to get $2,300 in tax arrears, which increased to $15,000 with penalties and interest. In 2015, Hennepin County, Minnesota, seized her condominium, sold it for $40,000, and pocketed $25,000 in surplus equity. On May 25, 2023, the United States Supreme Court unanimously held in Tyler v. Hennepin County that the municipality violated the Takings Clause of the U.S. Constitution when they stripped and retained Mrs. Tyler’s equity.

Read MoreThis is a report about how cities can better organize and manage their data about the property they own in order to promote transparency and advance critical policymaking. Newark, like many legacy cities, owns hundreds of parcels through tax foreclosure and abandonment that can be put to more productive use and even generate needed revenue. Because of different inputs from different departments, its property data system contained duplication and gaps that prevented policymakers and stakeholders from getting a clear picture of these public assets. In partnership with city staff, CLiME helped to resolve the data organization problem and set property management on a new, more accurate and user-friendly course. Along the way, we learned details about the nature and amount of city-owned properties, how they’re zoned and where they’re located. We concluded that much more of this significant inventory can and should be put to work advancing long-held goals of equitable development. We built three demonstrations to simulate this usage that cover three major areas of policy: affordable housing production, commercial and industrial development and green space/environmental risk mitigation. Each of these is an area in which the Baraka administration is already active in setting aggressive policies. Some of those policies already make use of the asset of city-owned land. Until recently, it was impossible to see the scope of particular uses because the data did not readily permit it. Now the data is cleaner and clearer.

Individual break-out reports from the full report are also available:

Simulation 1: Facilitate Development of 2,500 Units of Affordable Housing

Simulation 3: Transform abandoned spaces into green tools for climate resiliency and placemaking

Limited-Equity Cooperatives: A Primer on Sustainable Affordability and Wealth Building is a research report on a promising alternative to traditional homeownership in a period of scarce inventory and high interest rates. Limited equity cooperatives offer communal ownership at more affordable prices—stabilty, wealth enhancement and long-term affordability. Author Elana Simon details the purpose and structure of such housing vehicles.

Read MoreTo aid municipalities in regulating anonymous investor buying of 1-4 unit homes we drafted this model ordinance. A companion memorandum analyzes its legality and effectiveness under New Jersey law.

Read MoreContinuing CLiME’s work on regulating institutional investors of 1-4 unit dwellings in cities like Newark, this legal research memo explains and accompanies model legislation, showing cities exactly how to mandate transparency of ownership among anonymous LLCs.

Read MoreFew race-conscious public policies displaced African-American individuals and families like the federal urban renewal program from 1949 to 1974. Hundreds of cities spent millions of taxpayer dollars engaging in "slum removal" of entire neighborhoods only recently occupied by Blacks from the Great Migration. Their forced relocation—almost always without statutorily promised relocation expenses and assistance—was a harbinger of the modern ghetto and a blueprint for urban planning approaches that continue to this day.

As part of CLiME's Displacement Project, we began a broad inquiry into urban renewal in 2021. The results will follow in the form of academic papers, policy briefs and here, a growing archive of hard-to-find data on the program's implementation in select U.S. cities. CLiME Fellow and Bloustein graduate Erica Copeland assembled variables on the location, demographic variables and costs associated with primarily African-American displacement for a select period of time. We hope this contributes to a growing body of academic research on an under-appreciated aspect of systemic racism carried out by the federal and local governments at midcentury, whose wealth-retarding effects persist.

Read MoreNewark housing is too expensive for its residents.

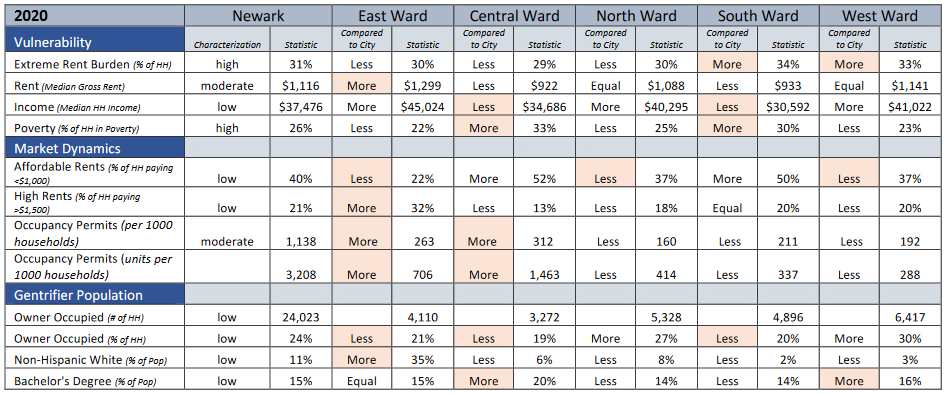

CLiME’s Displacement Risk Indicators Matrix—or DRIM—originated in 2017 as a tool to measure the risk of Newark resident displacement as a result of gentrification. We found then and now that displacement risk continues to be a serious threat to housing stability in Newark as rents rise dramatically among a city of mostly renters. Yet the cause does not appear to be traditional gentrification, because the demographic profile of who lives in the city, their incomes, educations and poverty rates have not changed as dramatically as rents.

The DRIM is divided into three sets of variables set across the city as a whole, the five wards and, for the first time, neighborhoods: vulnerability, market dynamics and “gentrifier population.” Vulnerability variables ask about the economic stresses that households feel. Market dynamics variables ask about rental affordability and new construction. Gentrifier population variables ask whether the city is seeing an influx in the people whose race, housing wealth and educational attainment is associated with gentrifying populations in other cities.

Read MoreThis report shows that the national trend in investor buying of 1-4 unit homes in predominantly Black neighborhoods is most acute in Newark, New Jersey where almost half of all real estate sales were made by institutional buyers. The trend grew out of the foreclosure crisis that wiped out significant middle-class wealth in particular Newark neighborhoods. Those neighborhoods became the targets of investors seeking passive returns from rents. Those largely anonymous outside companies now set neighborhood housing markets on terms that primarily benefit their investors.

While CLiME detected no illegal activity, the threats to Newarkers and government policy goals are significant. They include rapidly rising rents, decreased homeownership, higher barriers to affordable housing production goals, renter displacement and less stable communities. Sadly, this reality continues a long pattern of economic threats to predominantly Black and increasingly Latino neighborhoods in a state whose communities are among the most segregated in the country. From racial exclusion to predatory lending, from foreclosure to the extraction of rents, Newark’s experience demonstrates what can happen when local economies ignore equity.

CLiME’s analysis documents a dramatic increase in institutional investor activity in Newark’s residential market starting around 2013. As of 2020, almost half of all Newark’s residential sales were to institutional buyers.

Read MoreAffordable housing is increasingly scarce within the United States, and COVID-19 has dramatically exacerbated the simmering crisis in affordable housing. In New Jersey, the risk of eviction is greater than across the country, as 393,000 households are delinquent on their rent, (22.3% of households in renter-occupied housing units in New Jersey as compared with 15.8% across the country). ¹ In New Jersey, eviction pressure is faced disproportionately by residents of color, by households with children, and in urban municipalities, where more renters and more low-income households are especially vulnerable.

The New Jersey Housing Crisis in a COVID Era: Mapping Strategic Processes was a research project funded by the New Jersey State Policy Lab to explore strategic development and organizational learning in the provision of emergency rental assistance funding during the COVID-19 pandemic. This research focused on five New Jersey municipalities: Camden (Camden County), Elizabeth (Union County), Jersey City, Newark, and Trenton (Mercer County).

Read MoreHousing markets rebounded after the 2007-2009 housing crisis, but homeownership rates never did. Research explains this by the rapid spread of investor buyers into housing markets following the foreclosure crisis. Large investors bought significant numbers of properties that were foreclosed on, at very low prices, frequently converting single-family (1-4 units) into rental properties. They often acquire properties in low-income and moderate-income neighborhoods. ¹

Coming out of the foreclosure crisis, these investor buyers created a new industry around large-scale single-family rental, and have been increasingly active in rental markets generally. These limited liability companies (LLCs), or “corporate landlords”, have reshaped the legal landscape of rental ownership, in part because they limit investor liability. ² Research shows they are less likely to take care of the properties, causing them to fall into disrepair or remain vacant. ³ They are also associated with higher rents and higher rates of eviction. ⁴ Meanwhile, several reports document that the largest among them (e.g.; Invitation Homes, Equity Residential) are making enormous profits even as we experience a profound housing affordability and eviction crisis. ⁵

Read MoreOrange, East Orange, and Irvington are Black working-class suburban communities. While home to just under 20% of Essex’s population, they are home to almost 40% of all Black residents and only 2% of White residents. These communities are also growing fast, with surging Latino and immigrant populations from the Caribbean.

These inner-ring suburbs are challenged by elevated rates of poverty and a growing unaffordability, and they have few resources to address these pressing needs. In 2020, Orange, East Orange, and Irvington residents generated only $30,000-$40,000 in tax basis for essential public services, such as police, education and sanitation. Meanwhile, nearby Summit residents generated almost four and a half times as many resources as any of these communities, and to serve a much smaller population.

Read MoreCLiME conducted an affordability and gap analysis of Newark's housing stock and found a severe gap in low-rent units. We estimate that the City needs an additional 16,234 units renting for about $750 per month to meet residents' existing needs.

CLiME’s approach to assessing affordability is rooted in the local context. We calculate a Newark Median Affordable Rent (NMAR) of $763 per month. This is $330 less than Newark’s median market rent, and more than $600 less than Fair Market Rent (FMR), created by the Department of Housing and Urban Development. We also develop a methodological innovation to integrate the City’s rental housing subsidies into the affordability analysis. This procedure, the first of its kind as far as we know, provides a much closer picture of affordability in a City where at least 28% of all units are subsidized.

Read MoreLand banks are government-created institutions whose mission is to return vacant, abandoned and tax-delinquent properties into productive use. Land banks are empowered to acquire land, eliminate back taxes and tax liens attached to a property in order to create a clean title, maintain the land in compliance with local and state ordinances, and convey the property back into active use. As a mechanism for expediting the disposition of city-owned and/or abandoned properties, land banks can be a significant local government tool either for equitable growth or for more conventional economic development.

Read MoreIn this first installment of a faculty essay series, CLiME asked Rutgers professors affiliated with the center to provide brief analysis on some of the many institutional crises exacerbated by the Coronavirus pandemic and to offer solutions. Law Professor Rachel Godsil discuses the loss of public revenues to struggling communities and offers a pipeline to millions. Political Scientist Domingo Morel reveals the growing crisis in public pension fund commitments and a possible path to meeting those obligations. Law Professor Laura Cohen takes readers inside juvenile justice to show the increased risk of viral infection incarcerated youth face as well as the steps advocates are taking on their behalf. Director David Troutt looks into the future to interrogate claims that “we are all in this together” and offers an alternative set of policy priorities we would pursue if mutuality really mattered.

Read MoreFrom the perspective of many low-income families, gentrification is the ultimate social injustice; where “wealthy, usually white, newcomers are congratulated for "improving" a neighborhood whose poor, minority residents are displaced by skyrocketing rents and economic change.”

A social injustice promulgated by local government action, gentrification is no longer confined to our big cities and is increasingly impacting smaller cities and towns as municipalities seek to increase their tax base by luring wealthy residents in search of urban amenities and replace low income residents in the process.

Read MoreIn Tiny Houses in the City of Newark, Rutgers doctoral candidate Lenore Pearson studies innovative tiny house programs underway in Detroit, Michigan and analyzes their prospective application in Newark in a fascinating memorandum about unique urban housing solutions.

Read More